Tax Bracket For Head Of Household 2024

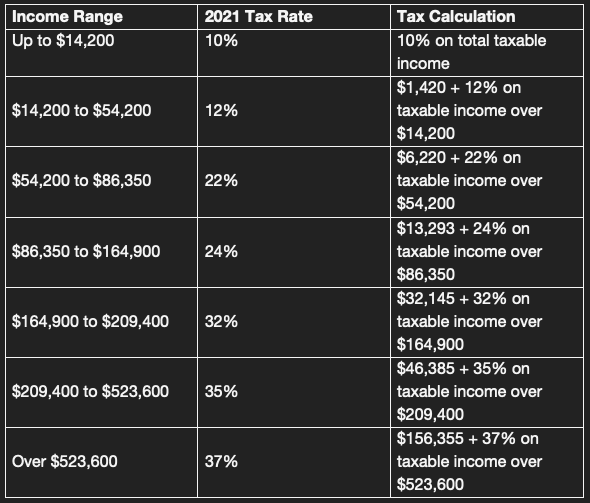

Tax Bracket For Head Of Household 2024. You pay tax as a percentage of your income in layers called tax brackets. The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808.

The income brackets each of these rates are. 8 rows credits, deductions and income reported on other forms or.

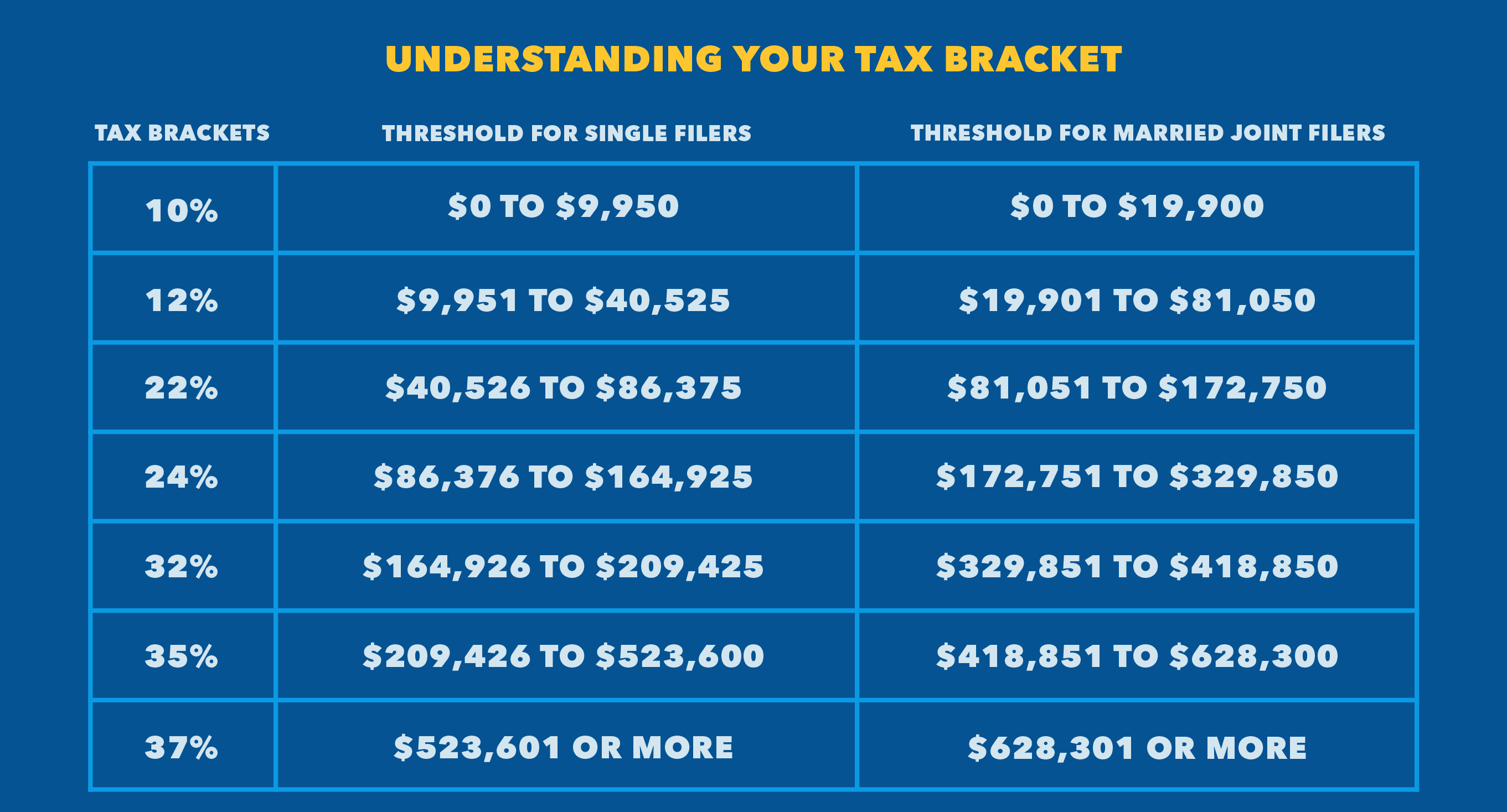

Your Tax Bracket Depends On Your Taxable Income And Your Filing Status:

Rate married filing jointly single individual head of household married filing separately;

Tax Rate Taxable Income (Married Filing Separately) Taxable Income.

Updated tax rates and brackets.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

Images References :

Source: rezfoods.com

Source: rezfoods.com

2022 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, What will change (again) are the income ranges. The 2024 standard deduction amounts are as follows:

Source: 1040taxrelief.com

Source: 1040taxrelief.com

2022 Tax Rates, Standard Deduction Amounts to be prepared in 2023, Federal income tax rates and brackets for 2023. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: bestfinanceeye.com

Source: bestfinanceeye.com

Federal Tax Earnings Brackets For 2023 And 2024 bestfinanceeye, The 2024 tax year features seven federal tax bracket percentages: 2024 tax brackets (taxes due in april 2025) the 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, For the 2023 and 2024 tax years, there are seven applicable tax rates: Tax rate taxable income (married filing separately) taxable income.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Tax rate taxable income (married filing separately) taxable income (head of household)) 10%: Higher standard deduction (2023) $20,800 standard deduction:

Here are the federal tax brackets for 2023 vs. 2022, Single or married filing separately: Marries filing jointly or qualifying widow tax brackets:

Source: www.blog.priortax.com

Source: www.blog.priortax.com

2021 Tax Brackets PriorTax Blog, The 2024 tax year features seven federal tax bracket percentages: Updated tax rates and brackets.

Source: www.pinkbike.com

Source: www.pinkbike.com

Enduro/AM The Weight Game Page 7471 Pinkbike Forum, Married couples filing separately and head of household filers; Higher standard deduction (2023) $20,800 standard deduction:

Source: margiewzorah.pages.dev

Source: margiewzorah.pages.dev

When Are California State Taxes Due 2024 Kary Sarena, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Single, married filing jointly or qualifying widow (er), married filing separately and head of.

Source: www.thestreet.com

Source: www.thestreet.com

Head of Household Qualifications, Tax Brackets and Deductions TheStreet, 8 rows credits, deductions and income reported on other forms or. For tax year 2024, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

The 2024 standard deduction amounts are as follows:

Your Tax Bracket Depends On Your Taxable Income And Your Filing Status:

To figure out your tax bracket, first look at the rates for the filing status you plan to use: